The NDP Provincial government introduced two initiatives that will impact housing in the three million dollar and up price point. As reported by Global News the Property Transfer Tax that is due when a house is sold will go from three to five per cent on these properties, bringing in an estimated $81 extra million dollars annually to the province. And where are those houses? They are predominantly in Point Grey, the University Endowment Lands, and in White Rock.

As well, school taxes will be increased for these houses with an increased tax of 0.2 per cent on the assessed value. If the house is worth over 4 million dollars, that tax will be 0.4 per cent. Duke of Data Andy Yan with the City Program at Simon Fraser University calls this initiative “policy innovation towards progressive wealth taxation” stating “We’re finally increasing the parking and club fees of the hedge city.”

Noting that Canada’s immigration policy on wealth expected to have taxable income as a result, the new housing taxes on multi million dollar houses are designed to deal with a global economy where it is challenging to trace and tax foreign income.

Yan said the NDP’s new housing taxes are a way of dealing with a “globalizing economy,” when foreign income has proven very difficult to trace and tax.

Andy also observed that there had not been much of a negative reaction to the new taxes. “There’s no Boston Tea Party in Coal Harbour,” Yan said, referencing a 1773 protest by Samuel Adams and the Sons of Liberty, who threw 342 chests of tea into Boston’s harbour to strike back against new taxes levelled by the British Parliament at the time.” There is also another tax as well if homeowners do not make income in British Columbia a new speculation tax that will be charged “at $5 for every $1,000 of assessed value this year, and $20 per $1,000 of assessed value next year.” That tax will take effect in the Fall of 2018.

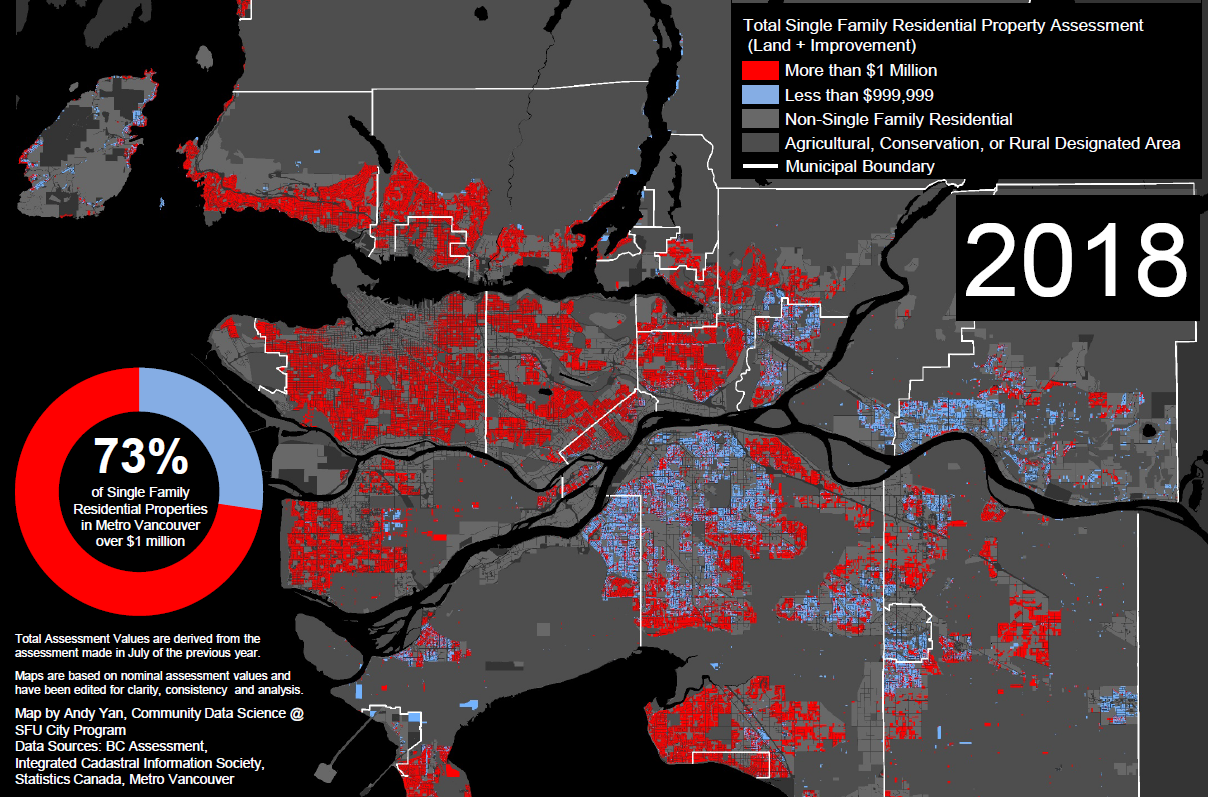

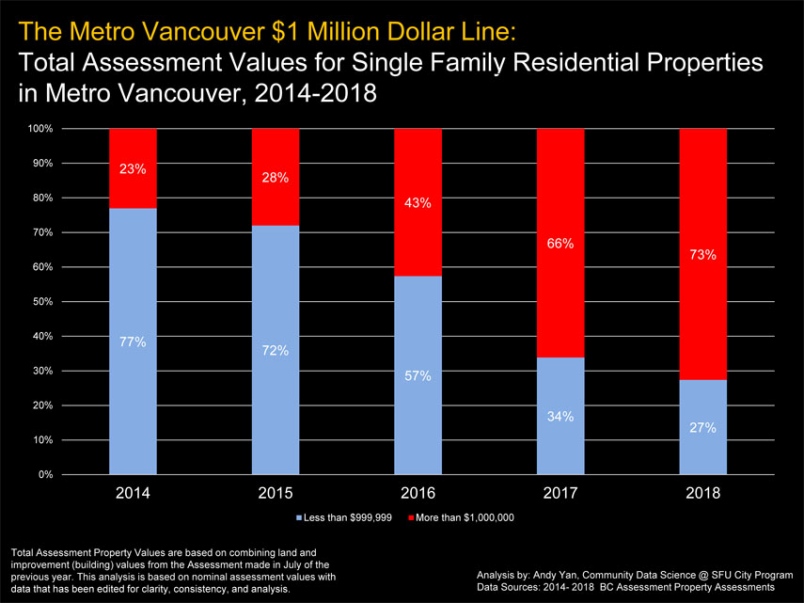

Images by Andy Yan

I think stating it WILL impact house prices is a tad premature, as we saw with the 15% foreign buyer’s tax. A short temporary downward blip I’d say .. with MANY unintended consequences.

Albertans (incl. folks from SK, MB or ON) that own vacation condos or second homes in Victoria or Kelowna are FURIOUS about the 2% tax ! Taxing a $600,000 Bear Mountain condo $1000/month extra will cause supply increase, for sure, but will NOT improve Victoria affordability but it will reduce future supply dramatically and IMMEDIATELY incl in Vancouver. As such prices will moderate temporarily for a year or so then at best flatline or continue their slow climb due to less supply.

Easy to circumvent the 2% non-resident tax by registering as a BC resident, for free healthcare for Albertans now, and also easy to open a BC corp and employ junior studying at UBC or the non-income tax paying wife.

Better would have been to increase property taxes FOR ALL, and reduce or eliminate income taxes like TX or WA but that was far too pro-business a step for the tax grabbing socialists fumbling in the dark for house cooling measures. Why not be honest and state “house prices will continue to be very high in most cities in BC” ?

Immigration may even increase as per federal edict and that will increase, not decrease, housing and renatl demand. Do provincial and federal politicians actually talk to each other ?

A move with many unintended consequences, such as reduced supply. Merely a tax grab.

Building 1000 affordable homes at $200,000 per year will eat up the $200M envisioned that this tax heist will collect. So yes, we will get some more affordable housing .. in time .. in 3-4 years due to long planning & build cycles.

I know several Albertans who own vacation property in the Okanagan, SE Interior and the Coast. They use the property maybe six weeks a year before retirement. They may well retire there. One way to avoid the tax is to rent out the cabin or condo in the off-season. This will create a new industry and jobs and additional income. There are lots of rental management models to choose from.

The other option is to allow yourself to throw reason out the window and sell out, blaming the socialists all the way.

Its a dangerous policy to punish recreational investors. It will affect supply and jobs. Money will shift elsewhere, say from Kelowna to Summerland, Peachland, Kamloops, Penticton, Oliver and Osoyoos; or from Victoria to Sydney, Sooke or Duncan.

The Kelowna (or Victoria) golf course condo owner and future developer loses, while folks in the region win.

Development in BC has just become a lot more risky. Supply will drop. Business around golf courses where Albertans frequent will drop as will employment. The tax will “initially” apply to five areas and MAY BE EXPANDED. RISKY BUSINESS !!

https://www.theglobeandmail.com/news/british-columbia/bc-monitoring-may-expand-locations-where-new-housing-speculation-tax-applied/article38078970/

Prices will NOT move much. Supply will be affected and local economies impacted.

Better would have been to tax every property in BC more, and to give an income tax credit to everyone, seniors, foreigners, Albertans etc .. ie indirectly BC residents win.

With $200M more in taxes collected barley 1000 affordable homes can be built annually, a huge disconnect to the promised numbers.

They are welcome to move here, pay bc taxes, and register to vote. This would be the best way for them to express this FURY

Many semi-retired couples just might, or just one of them (the one retired or on the lowest income), sucking in big BC healthcare $s and paying minimal income taxes.

btw: what is the minimum BC income taxes someone has to pay to be deemed a BC income tax paying resident ? A BC corp is easily opened for folks that own multi-million $ houses and pay the residing spouse or junior attending UBC a wage of say $12,000/year and pay $2 in BC income taxes. I bet these loopholes are being studied right now.

Better, like US states WA or TX do it, would have been to tax every property in BC more, and to give an income tax credit to everyone, seniors, foreigners, Albertans etc .. ie indirectly BC residents win. Or drop BC income taxes altogether, say for incomes up to $100,000. That would actually create jobs in BC and not eliminate them due to lower private housing supply.

I bet we haven’t seen the last of this policy yet as it has huge unintended consequences. Huge

With 73% of single-family detached homes in the Metro now worth over $1 million, it’s time to make it official:

The single-family detached home on a large lot is obsolete.

Actually, it is what people REALLY want. Only politicians, socialists and poor/envious people tell them otherwise.

The truth is : they are expensive and will continue t be expensive regardless of political party in power, and regardless of any gimmicky taxation policy enacted trying to manipulate the market.

Wanting something that is no longer physically possible to provide (i.e. the land detached houses sit on) will only lead to a greater shortage and higher prices.

So why don’t they if it is such a great idea ?

Answer: because it is not. Renters deteriorate your property, they cost management overheads, repair & maintenance and are often not worth the headaches, especially for $500,000+ homes.

How many rental properties do you own to be a sound judge here ?

The true result is: many Albertans will unload their condos, dropping prices maybe 10% and no student or lower income guy will buy $550,000 condos on Bear Mountain that dropped 10% in price from $600,000. It does NOTHING to create affordability. NOTHING.

It will however reduce employment as the next phase in Bear Mountain will not be built or severely delayed !

Here’s an interesting poll, Thomas. Seems many folks have had enough.

http://www.burnabynow.com/news/four-in-five-british-columbians-support-new-real-estate-taxes-1.23188832

deleted as per editorial policy

Many industry experts have doubts this will affect prices http://www.cbc.ca/news/canada/british-columbia/real-estate-industry-casts-doubt-on-b-c-s-housing-affordability-plan-1.4546341

2% taxes on vacation properties owned by Albertans (mainly in Victoria and Kelowna region) will NOT make housing more affordable in MetroVan http://www.cbc.ca/news/canada/calgary/alberta-property-owners-bc-tax-1.4548251 It will merely shift $s to other regions AND curb new supply immediately.

deleted as per editorial policy

Kelowna is the most unaffordable city and region after Metro Vancouver and Victoria. The NDP are being judicious.

Author

Reblogged this on Sandy James Planner.

Look out below!

http://www.huffingtonpost.ca/2018/03/02/vancouver-detached-home-sales-plunge-nearly-40-from-a-year-ago_a_23375609/

a 5% house price drop projected by TD .. woohoo .. like the 15% foreign buyer tax introduced 1.5 yeara ago which resulted in a temporary blip downwards. That is to be expected .. and then less growth .. $1M properties likely not affected at all ..

Time to carve up that expensive low density land into smaller, more affordable units with Missing Middle housing placed on it, 50% with rental suites.

Time to build public market level and non-market rentals by the thousands and remove them permanently from the private market.

114,000 “affordable” homes for $1.6B over 10 years .. we shall see what “affordable” means in this context with sky high land prices in Vancouver of $1M+ per 50 x 120 or 6000 sq ft lot or $7-10M per acre ! http://vancouversun.com/news/local-news/b-c-budget-2018-1-6-billion-allocated-for-housing-but-no-rebate-for-renters

Much hype here .. and too little honesty about true cost of new housing or timelines in an immigration society where immigrants concentrate on few regions. Not a word about that. None. Immigration will likely increase by 30-40% from roughly 300,000/yr today https://globalnews.ca/news/3782202/450000-immigration-target-canada/ Not even a debate here.

Perhaps, just perhaps very high house prices, very high rents and immigration are connected ?