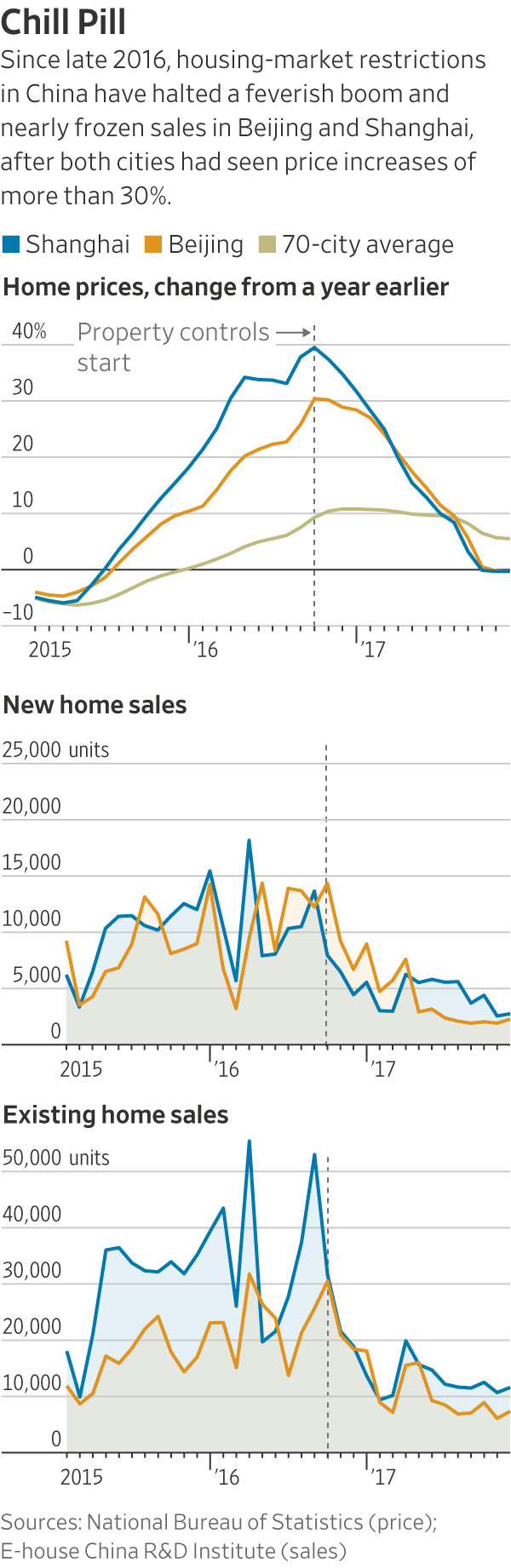

It had been forecast for some time with the tightening of lending and monetary restrictions. But as the Wall Street Journal reports housing prices are “stalled” in Beijing and Shanghai and prices are dropping in other cities.

Mansion Global observes “Demand has dried up in these areas as a result of government measures including higher mortgage rates, higher down-payment requirements and limits on buying a second or third home. Would-be sellers are increasingly putting plans on hold in hope that prices will rebound. While China has seen brief property downturns before, the high debt levels that fueled the boom makes this slump a particular risk for China’s economy and the policy makers trying to manage it.”

New home prices have decreased 8 per cent from October through to mid-December, a startling retreat from double-digit price increases in the previous year. As many Chinese families took on big and risky loans to buy apartments, price drops could mean some owners will owe more than they can sell the homes for. “New restrictions in many cities make it harder to unload a property. To ease the pressure, the government is encouraging the growth of a rental market.”

While overall house prices have increased by 7.5 per cent from the previous year, price drops in smaller cities without large population demand will mean no one will buy these units even at a discounted rate. The World Bank has identified property price uncertainty as a major concern in China’s growth in 2018. In Shanghai previous condo purchases in a development protested at a developer’s office as unit prices were decreased by seven per cent from the amount paid a year before.

“China’s property market accounts for a significant share of economic growth—as much as a third, according to Moody’s Investors Service—sending ripples outward into the global economy. The property boom stoked imports of housing materials, cars, appliances and other products. UBS called Chinese property one of the major engines of global growth in 2017.” If the real estate bubble is bursting in China, will there be any impact in Metro Vancouver real estate?

What would this be relevant to Vancouver? Foreign buyers only make up 2%-3% of the single family homes according to Statistics Canada

Surely you jest? Studies have shown a direct correlation between the Chinese economy and Vancouver home prices.

It’s too simplistic conclusion. It assumes there are lot of wealthy Chinese in China. This is a very skewed view. Majority are not.. Go ahead, do the research.

Remember, North America has outsourced a lot of jobs in certain sectors, to Asia because for those jobs, Chinese earn a lot lower wages. Hence, it total, could these low to low-middle income workers, earn enough to play Vancouver higher cost of real estate?

We are also forgetting that Canada has several other cities with real estate at much lower prices, amenities and liveable areas. Hence, there may be / well actually there IS other property buying stuff going on in other cities functioning ok under the Vancouverites’ radar.

It is a problem of this blog which does focus on Metro Vancouver /Cascadia and Vancouver news media…..missing out on other trends quietly happening in smaller Canadian cities here and there, for the past 5-10 years.

With 1.3B people if only 1% are wealthy that is over 13M people !

Add India, also now over 1B people and quickly growing in size and in middle- and upper-class wealth the money will continue to come to desirable places, especially those with weak to non-existing enforcement of tax laws, like Canada.

There are a lot more than 13M rich people in the EU economy of 500 million people. You don’t hear much about them though many have invested in BC for a lifetime.

Author

Reblogged this on Sandy James Planner.

The instructional part of the story is:

OMG! Interest rates actually have an impact on prices! Who would have thought! It was supposed to be only corrupt Asian money or something jacking prices, but actual economic forces? That’s totally outrageous!

🙂