Statistics Canada and the Canada Mortgage and Housing Corporation released some new figures about housing in the Metro Vancouver market, and those statistics open up more questions about what is truly going on in this region. As Jen St. Denis writes in Metro News buyers who don’t live in Canada like newer, bigger units are buying a more costlier product that local resident buyers. When Duke of Data and Simon Fraser University urbanist Andy Yan reviewed the figures, he found that new condo units started between 2016 and 2017 had a much higher percentage of non-resident owners. In Vancouver 19 per cent of these condo units were owned by non-resident buyers; the numbers were 24 per cent in Richmond and 23 per cent in Coquitlam.

Only 11 per cent of Vancouver condo units built between 2001 and 2005 were owned by non-resident buyers; 11 per cent in Richmond and 6 per cent in Coquitlam.

The City of Vancouver is embarking on a new Ten Year Housing Program to build and densify neighbourhoods and provide more of the “missing middle” of housing, often in the form of townhousing. But as Andy Yan observes, Vancouver is experiencing the “hyper-commodification” of real estate, and those townhouses being built for local families are proving to be very attractive to foreign owners. Between 2016 and 2016 187 townhouses were built in Vancouver. Of that 21 townhouses or 22 per cent of those new townhouse builds, over one fifth of that housing stock went to non-resident owners. The benchmark price for a townhouse is $861,900 in East Vancouver and $1.2 million on Vancouver’s west side, suggesting that the policy may need to be rethought about who is going to live in these and how they are going to afford them.

“The numbers are part of an effort by Statistics Canada and CMHC to collect and analyze more data on Canada’s housing market. In recent years, enormous price spikes in Vancouver and Toronto have led economists and housing experts to question how much of that effect is due to money flooding in from overseas sources. But a lack of data has stymied efforts to quantify the phenomenon.”

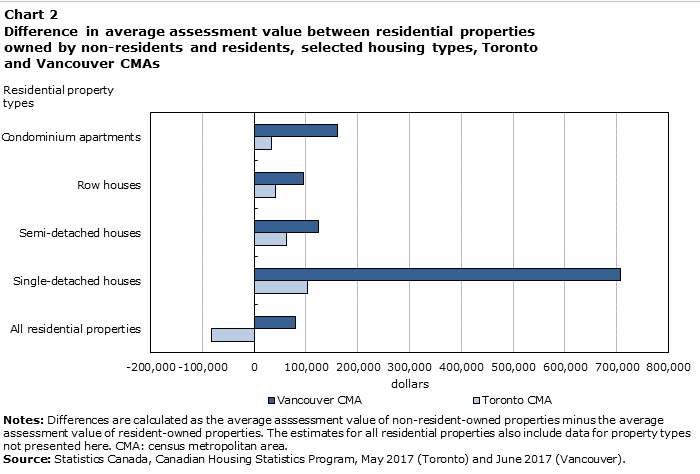

Questions are still being raised about the figures themselves, as some economists have been suggesting that the foreign money needs to be tracked, not just the foreign buyer who does not live in Canada and pay tax elsewhere. These figures do not include the flipping of property titles prior to building occupancy permits, or show when non-resident buyers purchase property in someone else’s name. In Metro Vancouver, non-residents own condos that are worth on average $161,200 more than those owned by full-time Vancouver residents, while single detached homes owned by non-residents were worth $707,800 more than those owned by residents.”

And in Vancouver itself non-residents like the most expensive parts of West Vancouver and the area inclusive of the University of British Columbia’s endowment lands. The statistics suggest some sobering realities of non-residents’ buying power and interests in the property market. However it does not track or follow the trail of foreign money in real estate market transactions. That analysis may reveal more.

Source: Metro News, Andy Yan

It is time to ban foreign ownership of real estate. There is no upside for the average Canadian.

Presumably in BC that would include retirees from Ontario and Alberta.

Dem dam ferners agin!

So let’s test the standard theory of supply and demand once and for all in one big experiment: ban all foreign ownership of any kind in Metro Vancouver for a period of 10 years.

While we’re at it, let’s kowtow to the Supply Mythers that development is causing our unaffordability crisis and stop all housing development for 10 years.

You can see how comically tragic it is to lay all housing unaffordability at the feet of so few people. My prediction in the above scenarios: prices will initially plummet, then spike even higher as demand pushes even harder on a constrained land supply.

These stats are not about foreign buyers. They are about nonresident buyers. There are 50,000 British Columbian snowbirds who live south of the border and many are defined as nonresident. The Stats Can/CMHC report should subtract the Canadians who have downsized to condos and who are for statistical purposes now considered ‘nonresident’.

These stats do not count Condo Pre sales and purchases by numbered companies which Foreigners engage in to avoid the 15% tax. So the impact is significantly higher.

Author

Reblogged this on Sandy James Planner.

Here are the numbers from the Stats Can / CMHC December 19th report on Metro Vancouver:

– 4.8% of all residential properties were non-resident owned, and accounted for 5.1% of the total property value.

– 4.9% of condos were non-resident owned

– 3.2 % of detached home stock was non-resident owned.

http://www.statcan.gc.ca/daily-quotidien/171219/dq171219b-eng.htm

Broken down in the Metro:

Vancouver: 7.6% of all housing is non-resident

Richmond: 7.5%

West Van: 6.2%

The majority of non-resident housing is in the form of condos. Presumably the rates are lower in other Metro communities.

With non-resident ownership under 10% in all jurisdictions studied, how does one reconcile the above numbers with the 173.7% rise in prices over the 2005-2017 period? How does one legitimately blame only non-residents foreigners for this rise? How does one reconcile the narrative bouncing around and around in the media echo chamber and on blogs on foreign ownership with the actual math?

Note that the CMHC is also working with the Canada Revenue Agency to try to pinpoint the actual levels of undeclared foreign income.

Alex, did you deliberately leave out the statistic that almost 1 in 5 new condos in Vancouver is foreign-owned? And the next time you say we need to build the “missing middle” please refer back to this fact:

“..Only weeks ago, the City of Vancouver adopted a 10-year housing strategy, which seeks, among other things, to address the housing crisis by dramatically increasing the new supply of so-called “missing middle” housing, including row-houses and semi-detached houses.

But Yan’s analysis showed that precise type of housing is owned by non-residents at almost twice the rate of other kinds of homes. While non-residents of Canada own 7.6 per cent of all housing types in the City of Vancouver, the data show they own 12.9 per cent of the most recently built “missing middle” housing…”

http://vancouversun.com/business/real-estate/cmhc-partners-with-stats-canada-for-report-on-non-resident-home-ownership

Anonymous brings up a good point: these stats aren’t about “foreign” buyers; they’re about “non-resident” buyers, of whom Canadian-born, non-resident snowbirds constitute a significant portion.

The problem isn’t foreigners. It’s the inability and/or unwillingness of the province to regulate short-term resales and the options market this has created; though I agree it’s easier to focus a mob against a bunch of dirty foreigners than an ethereal, almost-imaginary futures market. You can’t shake a pitchfork at an idea.

The math still leaves 92.4% and 87.1% RESIDENT owned respectively. You know, like the vast majority.

Why aren’t those numbers analyzed to the same degree? Could they by some chance actually lead to some answers to the high price dilemma?

Further, the rental vacancy rate is less than 1%, and rents have risen accordingly. What do the Supply Myth whisperers have to say about that in terms of supply / demand? Is that a myth too?

And you deliberately left out the Metro. Vancouver does not exist alone.

Vancouver contains or is immediately adjacent to the region’s biggest job generators:

Downtown Core, Broadway Corridor, UBC and YVR. It makes zero sense to sell 20% of the new multifamily housing stock to foreign buyers.

20%?

Burnaby alone had one billion dollars in development value in the past year predominantly in three town centres compared to Vancouver’s $1.3B There was another billion last year, and still another billion waiting in the wings for next year. There are several other Metro communities outside of Vancouver undergoing record levels of development too. This cannot be dismissed.

You make a good case defending Vancouver’s multi-use zoning and established job and residential centres (I’d add most commercial arterials to that list), which is also supports the case for the Broadway subway. But again, Vancouver does not exist alone, and affordability, as the data clearly shows, varies with location.

Getting back to affordability, Stats Can / CMHC will still need more accurate data from the CRA and real estate industry to determine what the exact influence of foreign buyers truly is here. I will not believe that it is more than the icing on the cake (maybe a thick icing at that) until the research has been completed.

Meanwhile: demand is still very high in part because interest rates are still at record lows; Gen Xers and Millennials are starting to receive scads of wealth in the form of undeclared early inheritances from their Boomer parents who are specifically targeting condo purchases for their kids; there is plenty of local speculation; we are out of undeveloped land; the majority of the land devoted to residential is used in extraordinarily inefficient ways; there is a dearth of attached housing types that allow family incomes to increase with a rental suite and catch up to prices; and there is a shortage of public or non-market rentals in sufficient quantities to counter the effects of a superheated market.

Is it not obvious how many of these points are related to supply shortages? That is, supply of land, supply of housing diversity, and supply that meets the high demand?

What’s the difference between foreign ownership and local greedy billionaires?