A ‘data column’ from the Seattle Times. (Note the irony of the header.)

Has Seattle reached “peak car”?

When it comes to the rate of ownership, it sure looks that way.

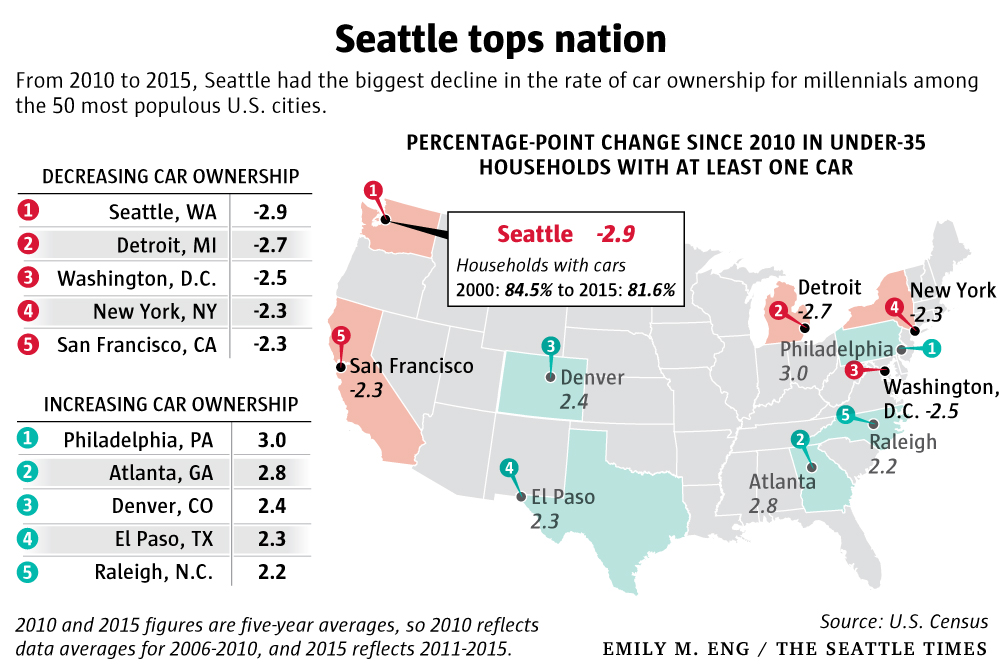

Census data show that from 2010 to 2015, the percentage of Seattle households that own a vehicle declined — that’s noteworthy because it’s something that hasn’t happened in decades.

I checked the data back to 1970. Car-ownership rates have creeped up every 10 years, right through to 2010. That year, 84.6 percent of city households owned at least one vehicle.

But suddenly, that number is dropping. As of 2015, it’s down by about 1 percentage point. And that’s almost entirely because of one group.

It’s a combination of economics and priorities, says Mark Hallenbeck, director of the Washington State Transportation Center at the University of Washington. As Seattle housing costs go through the roof, he says, cars are one expense that many young city dwellers are willing to sacrifice.

“If you get away from the high set of fixed expenses that go with owning a car — monthly payments, parking, insurance — you can pay for the apartment that allows you to live on Capitol Hill,” he said. “You can go out to bars to meet your friends, and you can get around everywhere you need to go.” …

A deeper look at the numbers shows that from 2010 to 2015, under-35 households without a car in Seattle — there are more than 17,000 of them — increased at a 10 times faster rate than those that do have at least one car.

That said, cars aren’t going away anytime soon in Seattle, a city that famously loves its Subarus and Priuses. Many Seattleites, even if they don’t drive much, still want to own a set of wheels for weekend excursions.

And in terms of the raw number of cars, Seattle probably hasn’t hit its peak. Even though carless households are growing faster, households with cars are still increasing, including those that own multiple cars. These forces pushed the city’s car “population” to 435,000 in 2015.

I wonder how a raise in oil prices will affect VMT’s? There is a correlation, and it was decreasing when prices were double what they are now. That was only three years ago. Cheap oil is not guaranteed forever.

Hey Alex, the retail price wasn’t double and that’s what would affect consumer habits. A lot of people are trapped into VMTs – or at least they think they are, Millennials are proving them wrong. But I see a lot fewer Hummers.

The last time I filled up my vehicle before I left Phoenix in May 2011 the gas prices were $3.75/gallon. Today they are $2.24, so not quite a doubling in US retail prices, but in the same ballpark.

For comparison, when I arrive in Vancouver in May 2011, gas was at $1.39/litre (approx $5.26/gallon). Today it is $1.37 ($5.18/gallon); a negligible change. However, in the meantime the Canadian dollar exchange rate has dropped from $1.05 to $0.73.

So why the retail price hasn’t dropped significantly in Canada, it appears that this could be due to the drop in the value of the Canadian dollar, because prices certainly have dropped in the US.

We can’t forget that in 2008 the world price of oil reached almost $150 / barrel. Now it’s less than 1/3rd that value (measured in US dollars). That peak caused tipping points to occur in the financial markets, and the rest is history.

Even at today’s low world price of oil, which resulted from a glut, we’re not that far from CAN$2 / litre here, which when passed could be one of those watershed moments. From what I’ve read in reports by independent and retired geologists not directly affiliated with oil companies, two of the five US shale formations will start a steep decline before 2020 based on the rock strata characteristics and past production data which clearly indicates that most of the sweet spots have already been tapped, and that oil and gas pumped from solid rock has extraordinary decline rates, some locations as much as 90% after just the first year. So they’ve gotta drill baby drill just to stay even. US shale is what created the glut, followed by OPEC purposely keeping their spigots open to drive the price down even further in an attempt to bankrupt overextended US shale outfits. That worked but only to a degree. But the geological limitations are looming.

In other words, the price will be unstable over the long run, and fracking will offer only a temporary economic lift while leaving a terrible environmental legacy.

looking forward to seeing this trend continue and parking requirements dropping, something that will hopefully liberate space and reduce cost of building.