by Michael Mortensen

If Socio-economic analysis was like climbing Everest, I’d want to be on the same climbing rope as demographer David Baxter.

Founder of the Urban Futures Institute , mentor to many, and longtime analyst of Vancouver’s changing scene, David has more “re-fired” rather than retired. To wit, he’s recently published four very interesting research and analysis papers (on his website here and cited below) that deserve consideration in any debate on Vancouver’s housing future. They’re fulsome, factual and engaging – a must read for anyone who wants to have an informed conversation on the current debate.

1 Vancouver is land constrained

2 Metro Vancouver’s population is growing – including Millennials

3 We need to focus on housing price stability AND targeted housing assistance

4 We can’t have low housing prices & low density

1/ Vancouver is land constrained … we’ve known for a long time that we’ll have higher land prices and we’ll need need higher density

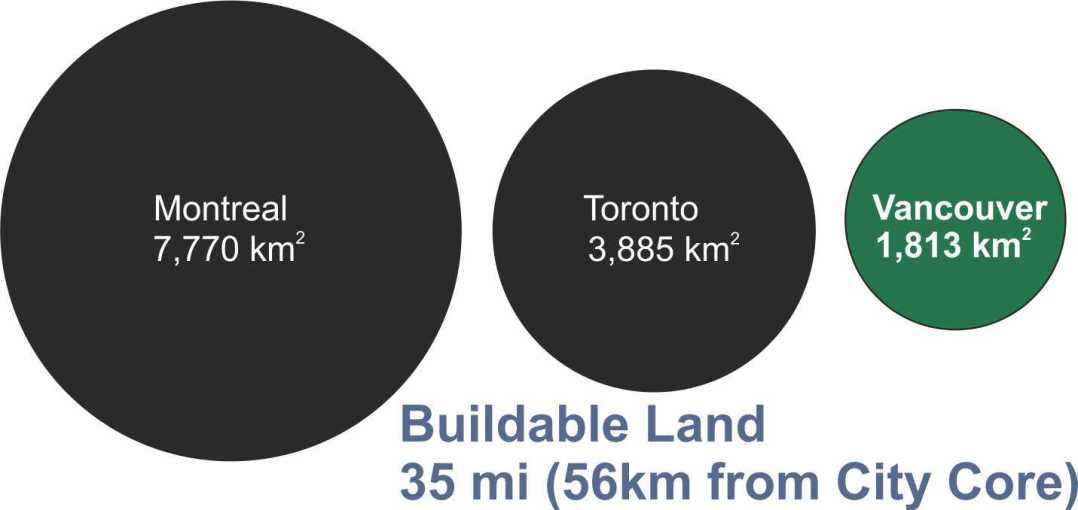

In “Land Supply: Scarce means Dense and Expensive, April 2016“ (click here) Baxter cites a 1975 Liveable Region study which illustrates our dilemma: we have a limited and finite land supply. The urban regions of Montreal and Toronto can (and have) expanded beyond 35 miles from their cores. In contrast, Greater Vancouver – hemmed in by mountains, ocean and the US border – cannot.

Baxter says we have to face these facts:

- Greater Vancouver’s population will continue to grow;

- Greater Vancouver has a limited and finite land base;

- Greater Vancouverites have chosen not to develop valuable agricultural land; and

- Land prices and density in Greater Vancouver will be greater than those in any other region in Canada.

2/ Metro Vancouver’s population is growing …

including Millennials

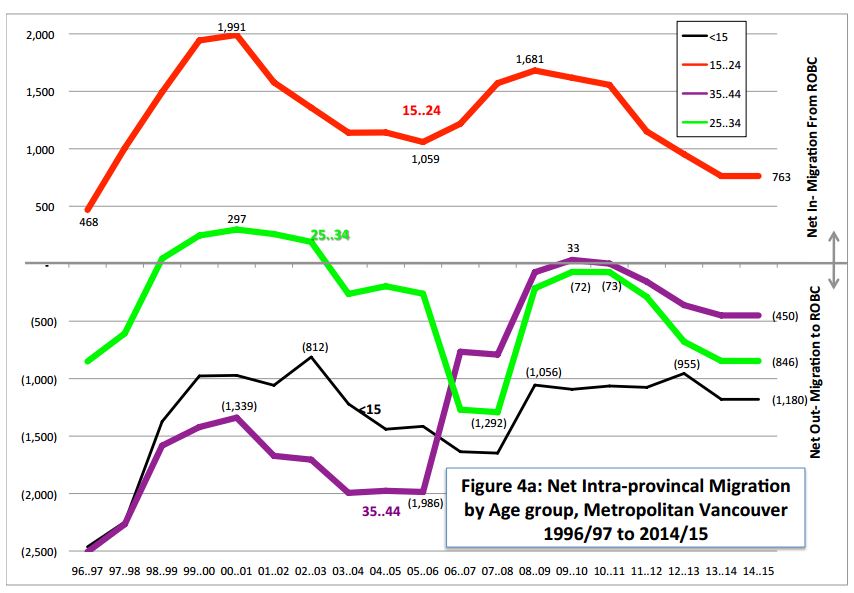

In “Coming and Going: Intra-provincial, Inter-provincial, and International Migration to and from Metropolitan Vancouver, May 2016“(click here) Baxter concludes that the increasing housing prices of the past four years are not driving people in any age group away from the region to other provinces; he asserts: “the data show exactly the opposite, that people from other provinces have been increasingly attracted to it, perhaps because for them the opportunities of this region outweigh the costs…”

3/ We should target house price stability and targeted assistance – not a housing price crash …

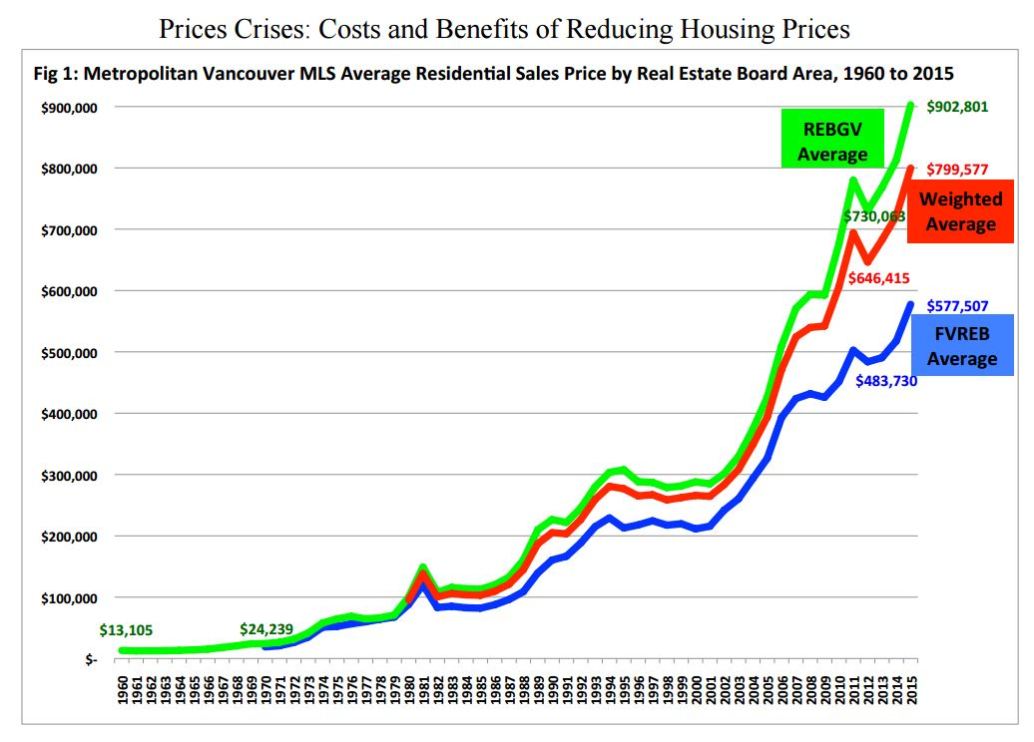

In “Prices Crises: Costs and Benefits of Reducing Housing Prices, April 2016“ (click here) David explores the idea of “affordable” housing in a region that has historically been unaffordable.

He asks, how much would we have to reduce prices for them to be affordable? And what would the costs and benefits be? He uses the average house price for 2012 as a working example. Baxter notes: “this value of $646,415 is 19% percent ($153,000) lower than the 2015 price.” and asks us, “So, what do you think? If prices were 19 percent lower today, would homes in Metropolitan Vancouver be affordable?”

His analysis:

Winners:

* 18,531 households would benefit by $153,000 each ($3B total benefits)

Losers:

* 656,966 existing households would each lose $153,000 ($100B total); plus

* anyone employed in the subsequent housing industry collapse

Baxter concludes that rather than market-wide interventions, Federal, Provincial and Local governments should be seeking price stability and instead target assistance to those who need it most.

4/ The City of Vancouver cannot have a stock of low density housing at lower prices …

Want to live close to work? Some do and some don’t. But with more than its share of regional jobs, people who want to live close to work will bid up house prices in Vancouver (for proximity and for other lifestyle benefits). We need more affordable [higher density] forms of development; competition [and prices] for these in high amenity city centres will be higher; and we need a regional approach to the problem of accommodating and moving the region’s population.

“Living Close: Concept and Consequence, March 2016”, click here.

Regional Housing & Transit

I do think we need a regional approach to the problem of accommodating and moving the region’s population to respond to these challenges.

Environmental and social sustainability and urban resilience compel us to strive for a mix of housing in ALL regional centres. Vancouver for example will not have only top-tier jobs but also a mix of other important and much-needed services performed by people who earn less. I think we need to be careful of disrupting existing stocks of affordable housing and that we can involve citizens, designers and developers to enable a range of higher intensity forms of infill housing that a) fit and complement our neighbourhoods and b) are highly viable for development.

In addition to housing, the Region’s transportation planning needs need to be addressed in a more cooperative manner. New transit creates new orders of access, new geographies of housing affordability and helps to address the “all in” cost of shelter and transport. Here the Province of BC stands out for its intransigence – it needs to come to the table and allow the region to direct major transportation investments and their funding

“Vancouver is land constrained … we’ve known for a long time” Yes, Michael, we’ve known that for a long time. So why do we tolerate such bad planning and development? We know the culprits . . .

Kudos!

This is the analysis we need to cut through the heated and shallow rhetoric about foreign money. Under the conjecture about speculation and the parking of gobs of cash in Vancouver from overseas rests something called ‘true value.’ Tax the heaven out of foreign real estate purchases as they did in Australia and you’ve still got high prices.

David Baxter’s work reinforces the notion that serious investments in regional transit beyond what is now planned is needed more than ever to accommodate a much higher demand for commuting between core job centres and cheaper housing close to the urban periphery. I suggest, though, that his buildable land number for Vancouver is about 1,000 km2 over. The Metro Urban Containment Boundary encompasses only a little more than 800 km2; the remaining ~2,000 km2 is comprised of watersheds, large parks and ALR lands.

This post also reinforces the notion that large lots with detached homes are obsolete in the Metro.

And not a word on foreign money or monetization of the BC or Vancouver brand ?

Yrs we have a supply issue but we cannot ignore the demand side either from foreign money, pension money, Gen Y folks and affluent immigrants all looking to buy buy buy.

Yes far more supply is required in GTA and MetroVan.

Yet, we do do not monetize the brand called Canada, BC, or Vancouver nearly enough. BMW or Mercedes doesn’t give their cars away. Neither should we. But we do. As such taxation has to be VASTLY increased for non-Canadians.

==> Don’t restrict foreign investment but monetize it far better !!

Taxes can make a massive impact if they are high enough .. Not 3 or 4% but 15% as in Sydney, London or Hongkong. Personally I think we ought to triple property taxes and charge a 25% land transfer tax on non-Canadian owned SFHs and half that for new condos.

Tax enforcement is also extremely weak in Canada and we lose billions annually by un- or under-reporting. A database of buyers – synced up with CRA – as now installed in BC will go a long way towards that. I wonder: why just buyers ? Why not sellers ?

Plenty of inaction and blame to lay on the provincial and federal level as they are asleep at the switch. Aplenty.

There are a few big fallacies in that winners and losers analysis.

Huge housing costs are a long term drag on the overall economy. When people are spending over 100% of their income just to live in a city (as the negative savings rate in BC indicates) then there isn’t investment going on in other parts of the economy. That leads to long term decay.

BC’s housing crisis is basically turning Vancouver into the equivalent of a petrostate with Dutch Disease. The costs of living as is will choke out other industries. The best talent will either end up in FIRE industries or leave due to lack of opportunity.

For the sake of some wealthy owner who “won the lottery” and have otherwise screwed the pooch on planning their retirement we’re going sink our non-FIRE economy?

I think we’re also long past the point of “targeted” housing assistance being effective. To make up for the current generational divide you would have add incredible amounts of housing to the public portfolio. In the end, that would only serve to farther polarise who can afford to live here. The rich who can afford the market, and the poor who can are shielded from the market. This would farther allow the market side of things to spiral out of control and squeeze out the middle. Just look at SF.

The people in the FIRE industry also should have been saving and diversifying in the mean time. If they haven’t, well to bloody bad. Every other cyclical industry undergoes the same thing. Buildings will still get built, maintenance will be done and small jobs will keep the core going, but who cares if a small army of realtors around here have to step down to a VW instead of an Audi?

There is a reason that the other most unaffordable cities in the world (Hong Kong and Singapore) have large stocks of council housing – they are similarly constrained, face other issues in a similar manner (cash inflows/etc) but the parallel market allows the link of affordability to housing availability to be severed.

Do you really see that working here? In both Hong Kong and Singapore, national entities are confronted by the same problem. Vancouver within Canada is a much smaller political entity and would be substantially more limited in what social policies could be tailored to suit. The argument can always be made that Vancouverites could move somewhere cheaper. HK or Singapore don’t really have that luxury.

The feds aren’t going to write a whole bunch of rules or bodies which apply nationally, when the problem only affects 1/15th the national population.

Plenty of tax evaders across the country in real estate by folks who do not report real estate sales. Metrovan plus GTA together probably count for 25% of its housing and 33% of its value.

I know MB mentioned it, but could somebody confirm that that buildable land figure in fact does not include the ALR. Thanx.

I’ve always wondered where the folks who can’t afford housing in Vancouver live.